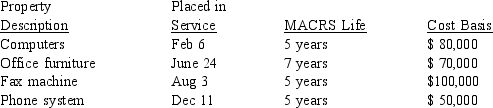

The Cox Accounting Firm places the following property in service during the 2014 tax year:  Cox wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Cox will report 2014 taxable income in the amount of $100,000 before consideration of depreciation on their 2014 property acquisitions. Cox elects out of bonus depreciation. What is the maximum combined amount of depreciation and Section 179 expense that may be obtained under this set of fact circumstances?

Cox wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Cox will report 2014 taxable income in the amount of $100,000 before consideration of depreciation on their 2014 property acquisitions. Cox elects out of bonus depreciation. What is the maximum combined amount of depreciation and Section 179 expense that may be obtained under this set of fact circumstances?

A) $45,555

B) $50,000

C) $56,003

D) $81,003

E) $89,000

Correct Answer:

Verified

Q64: The Ross CPA Firm places the following

Q65: Wellington Company purchases a new warehouse on

Q66: Lindale Rentals places an apartment building in

Q67: Wellington Apartments purchases an apartment building on

Q68: The Lovell Accounting Firm places the following

Q71: Tucker Estates places an apartment building in

Q72: On August 3, 2014, Yang purchases office

Q73: Chestnut Furniture Company purchases a delivery van

Q74: Jim places a new lift truck 7-year

Q78: Why might a taxpayer elect to depreciate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents