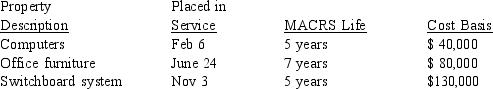

The Ross CPA Firm places the following property in service during the 2014 tax year:  Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

Ross wants to obtain the maximum possible depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Ross will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is Ross' maximum depreciation from these additions?

A) $20,000

B) $25,000

C) $29,694

D) $34,780

E) $45,432

Correct Answer:

Verified

Q59: Ralph buys a new truck 5-year MACRS

Q60: Shannon purchases equipment classified as 3-year property

Q61: Delta Freight Company purchases 10 delivery vans

Q62: Mountain View Development Co. purchases a new

Q63: The Boatright Accounting Firm places the following

Q65: Wellington Company purchases a new warehouse on

Q66: Lindale Rentals places an apartment building in

Q67: Wellington Apartments purchases an apartment building on

Q68: The Lovell Accounting Firm places the following

Q69: The Cox Accounting Firm places the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents