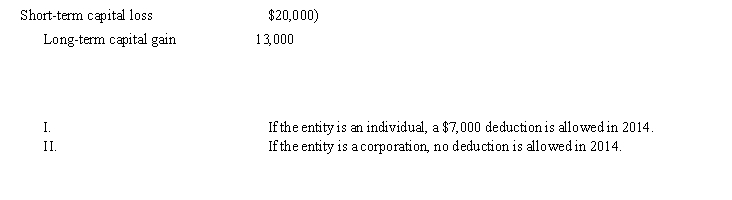

A taxable entity has the following capital gains and losses in 2014:

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q36: Courtney and Nikki each own investment realty

Q36: LeRoy has the following capital gains and

Q38: Gabrielle has the following gains and losses

Q39: Morgan has the following capital gains and

Q40: In July 2014, Harriet sells a stamp

Q43: Santana purchased 200 shares of Neffer, Inc.

Q44: Omicron Corporation had the following capital gains

Q45: Sally owns 700 shares of Fashion Styles

Q46: When securities are sold and the securities

Q53: Sidney,a single taxpayer,has taxable income of $45,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents