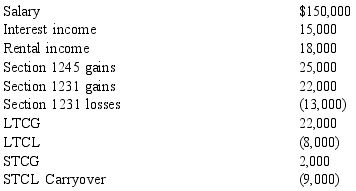

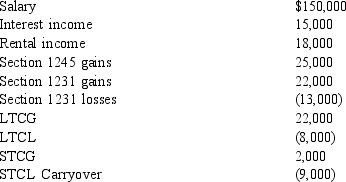

Warren's 2014 adjusted gross income consists of the following items:

Warren's combined §1231 gains and losses recognized over the prior five tax years included a net loss of $10,000. The STCL carryover arose from a loss reported in 2009. What net amounts of ordinary income, LTCG income and STCG income will Warren's 2014 adjusted gross income consist of? i.e. what amounts are reported after completing the netting process?) Ordinary Income LTCG STCG

Warren's combined §1231 gains and losses recognized over the prior five tax years included a net loss of $10,000. The STCL carryover arose from a loss reported in 2009. What net amounts of ordinary income, LTCG income and STCG income will Warren's 2014 adjusted gross income consist of? i.e. what amounts are reported after completing the netting process?) Ordinary Income LTCG STCG

A) $208,000 $16,000 $ - 0 -

B) $217,000 $14,000 $7,000)

C) $208,000 $23,000 $7,000)

D) $217,000 $ 7,000 $ - 0 -

Correct Answer:

Verified

Q105: If an individual sells depreciable real estate

Q110: Mario is a real estate and financial

Q110: Which of the following trade or business

Q111: Pedro sells a building for $170,000 in

Q114: Milton has the following transactions related to

Q115: Rosalee has the following capital gains and

Q117: During 1999, Trump Corporation bought a factory

Q131: What incentive provisions or preferential treatments exist

Q133: Matt has a substantial portfolio of securities.

Q139: Explain why a taxpayer would ever consider

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents