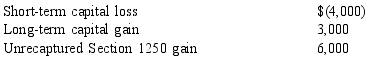

Rosalee has the following capital gains and losses during the current year:

If Rosalee is in the 33% marginal tax rate bracket before considering her capital gains and losses, how much tax does she pay on her capital gains?

If Rosalee is in the 33% marginal tax rate bracket before considering her capital gains and losses, how much tax does she pay on her capital gains?

A) $ 950

B) $1,100

C) $1,250

D) $1,500

Correct Answer:

Verified

Q110: Mario is a real estate and financial

Q111: Pedro sells a building for $170,000 in

Q113: Warren's 2014 adjusted gross income consists of

Q114: Milton has the following transactions related to

Q117: During 1999, Trump Corporation bought a factory

Q120: Nicole has the following transactions related to

Q131: What incentive provisions or preferential treatments exist

Q132: Discuss the general differences between Section 1245

Q133: Matt has a substantial portfolio of securities.

Q139: Explain why a taxpayer would ever consider

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents