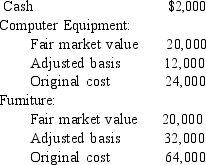

During 2014, Jimmy incorporates his data processing business. Jimmy is the sole shareholder. The following assets are transferred to the corporation:  How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

How much gain loss) will Jimmy recognize from the transfer of the assets to the corporation?

A) $-0-

B) $4,000)

C) $8,000

D) $20,000

E) $12,000)

Correct Answer:

Verified

Q42: Leonor is the financial vice-president and owns

Q46: Jack owns a 50% interest in the

Q47: Chase, Marty and Barry form a partnership.

Q47: During 2014, Jimmy incorporates his data processing

Q48: Gomer is admitted to the Mouton Partnership

Q51: Bison Financial Group has a health-care plan

Q53: Rosen Group has a company health-care plan

Q53: Sergio and Chris agree to combine their

Q57: Larry and Laureen own LL Legal Services

Q57: Carlotta is the director of golf for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents