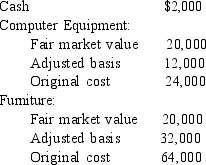

During 2014, Jimmy incorporates his data processing business. Jimmy is the sole shareholder. The following assets are transferred to the corporation:  What will be the basis of the assets to the corporation after the transfer?

What will be the basis of the assets to the corporation after the transfer?

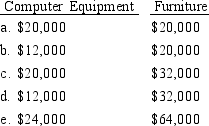

Correct Answer:

Verified

Q41: Moses is a 20% partner in an

Q43: Pomeroy Corporation has a company health-care plan

Q45: June is a 20% owner-employee in the

Q47: Chase, Marty and Barry form a partnership.

Q48: Gomer is admitted to the Mouton Partnership

Q51: Bison Financial Group has a health-care plan

Q52: During 2014, Jimmy incorporates his data processing

Q57: Larry and Laureen own LL Legal Services

Q59: Which of the following entities can provide

Q60: "Double taxation" occurs

A)because corporate tax rates are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents