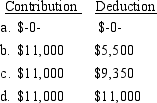

Cisco and Carmen are both in their 30's and are married. Carmen earns $69,000 and Cisco earns $28,000. Their adjusted gross income is $102,000. Carmen is an active participant in her company's pension plan. Cisco's employer does not have a pension plan. What are Carmen and Cisco's maximum combined IRA contribution and deduction amounts?

Correct Answer:

Verified

Q26: Kathy and Patrick are married with salaries

Q27: Ken is a 15% partner in the

Q27: The maximum contribution that can be made

Q28: Sergio is a 15% partner in the

Q29: Alex is 37 years old, single and

Q29: Ross and Reba are both in their

Q32: Isabelle and Marshall are married with salaries

Q32: Curtis is 31 years old, single, self-employed,

Q34: Under a Roth IRA I. Any taxpayer

Q36: Arturo is a 15% partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents