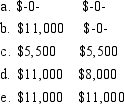

Kathy and Patrick are married with salaries of $28,000 and $21,000, respectively. Adjusted gross income on their jointly filed tax return is $54,000. Both individuals are active participants in employer provided qualified pension plans. What are Kathy and Patrick's maximum combined IRA contribution and deduction amounts? Contribution Deduction

Correct Answer:

Verified

Q21: The maximum contribution that can be made

Q23: Lynne is a 15% partner with Webb

Q24: Posie is an employee of Geiger Technology

Q27: The maximum contribution that can be made

Q27: Ken is a 15% partner in the

Q28: Sergio is a 15% partner in the

Q29: Alex is 37 years old, single and

Q30: Sonya is an employee of Gardner Technology

Q31: Cisco and Carmen are both in their

Q40: Kyle is 31 years old, single, self-employed,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents