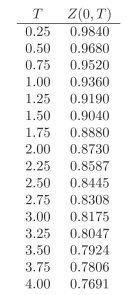

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 4 units of a 1.5-year ?xed rate bond paying 4% quarterly.

ii. 5 units of a 1.5-year ?xed rate bond paying 5% semiannually.

iii. 10 units of a 1.5-year zero coupon bond.

iv. 3 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

Correct Answer:

Verified

Q2: How many securities do you need to

Q3: Compute the Term Spread and the Butterfly

Q4: You currently hold a 2-year fixed rate

Q5: Use the following discount factors when needed.

Q6: You currently hold a 7-year fixed rate

Q7: If you need three securities to hedge

Q8: What is the advantage of a factor

Q9: Use the following discount factors when needed.

Q10: You currently hold a 7-year ?xed rate

Q11: Use the following discount factors when needed.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents