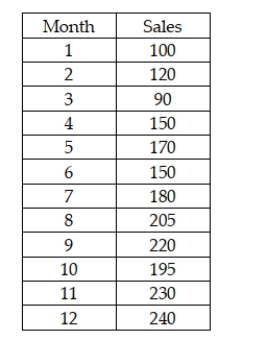

The Morgan Company is interested in developing a forecast for next month's sales. It has collected sales data for the past 12 months.  After analyzing these data, if the company wishes to use double exponential smoothing with alpha = 0.20 and beta = 0.20, the starting values for the constant process and the trend process can be derived from a linear trend regression model by using the intercept and slope coefficient respectively.

After analyzing these data, if the company wishes to use double exponential smoothing with alpha = 0.20 and beta = 0.20, the starting values for the constant process and the trend process can be derived from a linear trend regression model by using the intercept and slope coefficient respectively.

Correct Answer:

Verified

Q59: The purpose of deseasonalizing a time series

Q60: Recently, a manager for a major retailer

Q61: In a recent meeting, the marketing manager

Q62: In a single exponential smoothing model, one

Q63: Because simple exponential smoothing models require a

Q65: If you suspect that your time-series data

Q66: Prior to conducting double exponential smoothing a

Q67: Double exponential smoothing is used instead of

Q68: The process of selecting the forecasting technique

Q69: In establishing a single exponential smoothing forecasting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents