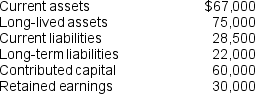

Gomer Paper Corporation has the following balance sheet accounts immediately preceding an investing and financing decision:

A long-term debt covenant specifies that Gomer Paper's debt/equity ratio cannot be greater than 1.0 and its current ratio must be at least 2.0.

A long-term debt covenant specifies that Gomer Paper's debt/equity ratio cannot be greater than 1.0 and its current ratio must be at least 2.0.

Gomer Paper is going to invest $70,000 in new equipment. It is considering two methods of financing the investment. It can use $10,000 of its own money and obtain $60,000 from the issue of long-term debt. Alternatively, Gomer Paper can use $15,000 of its own money and obtain the remaining financing from the issue of stock.

A. Recalculate the balance sheet amounts given above for each of the two financing alternatives immediately after financing is achieved and the investment is undertaken.

B. Use numerical calculations to determine if the debt covenants are respected under each of the two financing alternatives. If the covenants are broken for each alternative, suggest financing options that Gomer Paper might use to finance the $70,000 investment in equipment.

Correct Answer:

Verified

The debt/equity ratio exceeds th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Immediately before a 3-for-1 stock split was

Q68: Immediately before a $4,000 cash dividend was

Q87: Seneca Corporation has the following balance sheet

Q87: Which characteristics make equity financing more advantageous

Q88: Identify the two components of shareholders' equity.

Q89: What balance sheet condition does a deficit

Q91: How is the excess of cash receipts

Q94: Tropical Corporation has the following amounts as

Q94: What rights do preferred shareholders have that

Q96: Explain par value.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents