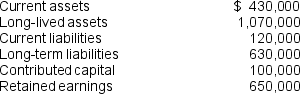

Seneca Corporation has the following balance sheet accounts immediately preceding an investing and financing decision:

A long-term debt covenant specifies that Seneca's debt/equity ratio cannot be greater than 1.0 and current ratio cannot be less than 2.0.

A long-term debt covenant specifies that Seneca's debt/equity ratio cannot be greater than 1.0 and current ratio cannot be less than 2.0.

Seneca is going to invest $600,000 in a new machine that will keep Seneca Corporation in an excellent competitive position in a very competitive industry. In order to finance this investment, Seneca will use its cash, issue long-term debt, and issue common stock. However, besides having to adhere to the debt covenants, Mr. Seneca, the sole owner of Seneca Corporation, will not issue more than $100,000 of common stock so that he can retain at least a 50% ownership in his corporation.

Can Seneca Corporation finance the $600,000 investment and still adhere to the debt covenants and allow Seneca to retain at least 50% ownership? If Seneca cannot finance the machine within the parameters given, suggest possible means for Seneca to finance the needed acquisition of the machine.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Immediately before a 3-for-1 stock split was

Q68: Immediately before a $4,000 cash dividend was

Q79: If a corporation distributes a 4-for-3 stock

Q80: A sequence of events affecting the shareholders'

Q81: What makes preferred stock questionable in classification?

Q82: Immediately before a 15% stock dividend was

Q83: How do the book value and market

Q89: What balance sheet condition does a deficit

Q92: Gomer Paper Corporation has the following balance

Q96: Explain par value.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents