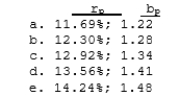

Assume that you hold a well-diversified portfolio that has an expected return of 12.0% and a beta of 1.20. You are in the process of buying 100 shares of Alpha Corp at $10 a share and adding it to your portfolio. Alpha has an expected return of 15.0% and a beta of 2.00. The total value of your current portfolio is $9,000. What will the expected return and beta on the portfolio be after the purchase of the Alpha stock?

Correct Answer:

Verified

Q21: You hold a diversified portfolio consisting of

Q22: You are holding a stock with a

Q22: Which of the following statements is CORRECT?

A)

Q22: You are given the following returns on

Q23: Calculate the required rate of return for

Q24: Data for Oakdale Furniture, Inc. is shown

Q25: The returng on the market, the

Q28: Consider the following information and then calculate

Q29: Which of the following are the factors

Q30: Assume an economy in which there

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents