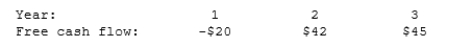

Vasudevan Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

Correct Answer:

Verified

Q5: Suppose Yon Sun Corporation's free cash flow

Q7: Simonyan Inc. forecasts a free cash flow

Q8: If a company's expected return on invested

Q15: Suppose Leonard, Nixon, & Shull Corporation's projected

Q16: Which of the following is NOT normally

Q17: ESOPs were originally designed to help improve

Q19: Akyol Corporation is undergoing a restructuring, and

Q22: Based on the corporate valuation model, the

Q24: Based on the corporate valuation model, the

Q24: Based on the corporate valuation model, Hunsader's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents