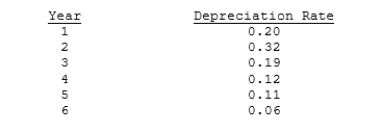

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $ 8,878

B) $ 9,345

C) $ 9,837

D) $10,355

E) $10,900

Correct Answer:

Verified

Q42: Which one of the following would NOT

Q61: Desai Industries is analyzing an average-risk project,

Q62: Liberty Services is now at the end

Q62: Aggarwal Enterprises is considering a new project

Q63: Poulsen Industries is analyzing an average-risk project,

Q65: Florida Car Wash is considering a new

Q66: Foley Systems is considering a new investment

Q67: Thomson Media is considering some new equipment

Q68: TexMex Food Company is considering a new

Q70: Sub-Prime Loan Company is thinking of opening

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents