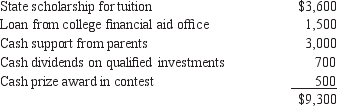

Roger Burrows, age 19, is a full-time student at Marshall College and a candidate for a bachelor's degree. During 2012, he received the following payments:  What is Burrows's adjusted gross income for 2012?

What is Burrows's adjusted gross income for 2012?

A) $1,100

B) $1,200

C) $4,800

D) $9,300

Correct Answer:

Verified

Q42: Which of the following statements is correct?

A)

Q43: Richard and Alice Kelley lived apart during

Q44: Mark Mayer, a cash basis taxpayer, leased

Q45: Under the terms of their divorce agreement

Q46: Kevin is a candidate for an undergraduate

Q48: Mason, an accrual basis taxpayer, owns a

Q49: All of the following are requirements for

Q50: Percy Peterson received a grant from the

Q51: Each of the following would be one

Q52: Johnny, a cash basis taxpayer, owns two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents