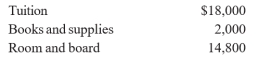

Kevin is a candidate for an undergraduate degree at a local university. During 2012, he was granted a fellowship that provided the following:  What amount can Kevin exclude from gross income in 2012?

What amount can Kevin exclude from gross income in 2012?

A) $18,000

B) $20,000

C) $25,000

D) $32,800

E) $34,800

Correct Answer:

Verified

Q41: James and Edna Smith are a childless

Q42: Which of the following statements is correct?

A)

Q43: Richard and Alice Kelley lived apart during

Q44: Mark Mayer, a cash basis taxpayer, leased

Q45: Under the terms of their divorce agreement

Q47: Roger Burrows, age 19, is a full-time

Q48: Mason, an accrual basis taxpayer, owns a

Q49: All of the following are requirements for

Q50: Percy Peterson received a grant from the

Q51: Each of the following would be one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents