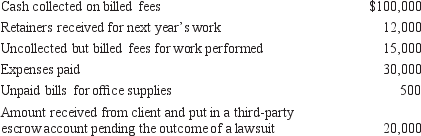

Sylvester Sueem, attorney-at-law, reports his income on the cash basis. Last year his books reflected the following:  Sylvester's net self-employment income last year was:

Sylvester's net self-employment income last year was:

A) $70,000

B) $84,500

C) $82,000

D) $96,000

Correct Answer:

Verified

Q24: Robert Graves sold his house to George

Q25: Simond is the owner of a hair

Q26: Which entities must have tax years that

Q27: All of the following deferred payment sales

Q28: fte following statements about LIFO inventory are

Q30: fte uniform capitalization rules apply to which

Q31: Jake Turner realized last December that he

Q32: Jones has two separate businesses. Jones:

A) must

Q33: fte following statements about cash and accrual

Q34: Greg Owens owns a four-flat building. Last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents