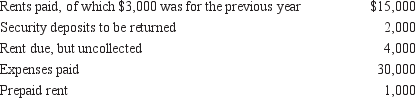

Greg Owens owns a four-flat building. Last year, he recorded the following items:  His gross rental income, depending on whether he is on the cash or accrual basis, amounted to:

His gross rental income, depending on whether he is on the cash or accrual basis, amounted to:

A) Cash: $16,000; accrual: $17,000

B) Cash: $13,000; accrual: $17,000

C) Cash: $18,000; accrual: $16,000

D) Cash: $17,000; accrual: $17,000

Correct Answer:

Verified

Q29: Sylvester Sueem, attorney-at-law, reports his income on

Q30: fte uniform capitalization rules apply to which

Q31: Jake Turner realized last December that he

Q32: Jones has two separate businesses. Jones:

A) must

Q33: fte following statements about cash and accrual

Q35: A corporation must "annualize" a short taxable

Q36: fte following statements about dispositions of installment

Q37: fte following statements about inventories for tax

Q38: fte following statements about the cash basis

Q39: All of the following statements regarding accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents