Multiple Choice

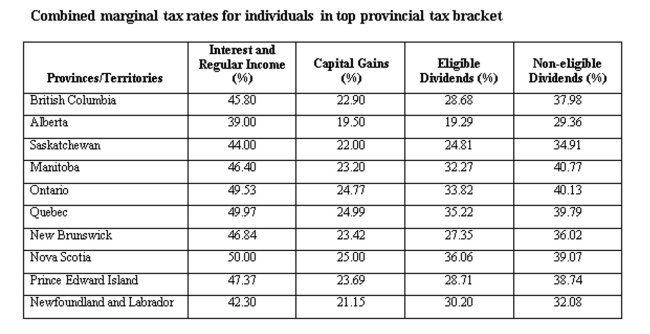

A Saskatchewanresident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 28.46%

B) 28.97%

C) 30.36%

D) 30.97%

E) 31.46%

Correct Answer:

Verified

Related Questions

Q186: If provincial tax rates are 16% on

Q187: What is the firm's change in net

Q188: Peter owns The Train Store which he

Q189: If provincial tax rates are 16% on

Q190: Calculate cash flow from assets given the

Q192: A British Columbia resident earned $30,000 in

Q193: If cash flow from operations is $938,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents