Multiple Choice

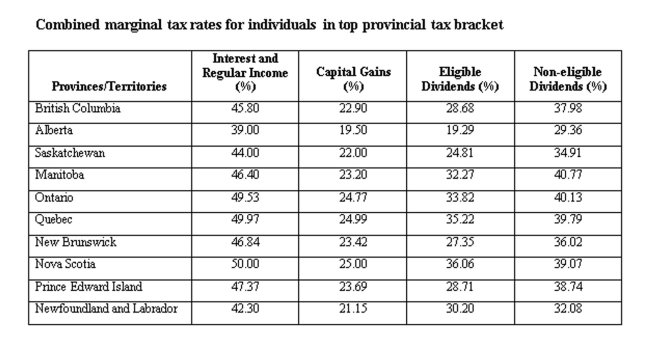

A British Columbia resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 29.83%

B) 30.44%

C) 31.26%

D) 31.86%

E) 32.23%

Correct Answer:

Verified

Related Questions

Q187: What is the firm's change in net

Q188: Peter owns The Train Store which he

Q189: If provincial tax rates are 16% on

Q190: Calculate cash flow from assets given the

Q191: A Saskatchewanresident earned $30,000 in capital gains

Q193: If cash flow from operations is $938,

Q193: Which of the following are included in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents