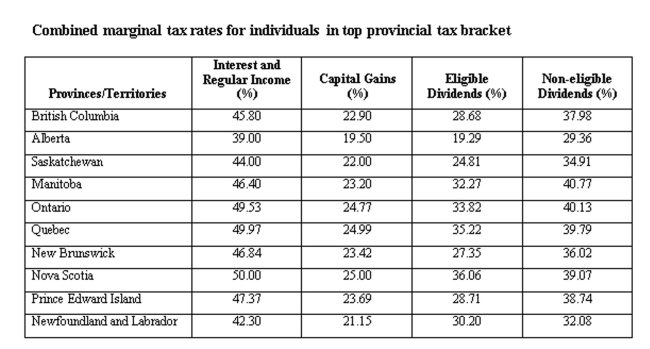

A Saskatchewan resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 28.49%

B) 29.49%

C) 30.49%

D) 31.49%

E) 32.49%

Correct Answer:

Verified

Q177: What is the amount of the non-cash

Q178: Celeste Video, Inc. reports 2015 taxable income

Q179: Suppose that a firm paid dividends of

Q180: A $40,000 asset was purchased and classified

Q181: A Quebec resident earned $30,000 in capital

Q183: The marginal tax rate on an income

Q184: Given the tax rates as shown, what

Q185: If provincial tax rates are 16% on

Q186: If provincial tax rates are 16% on

Q187: What is the firm's change in net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents