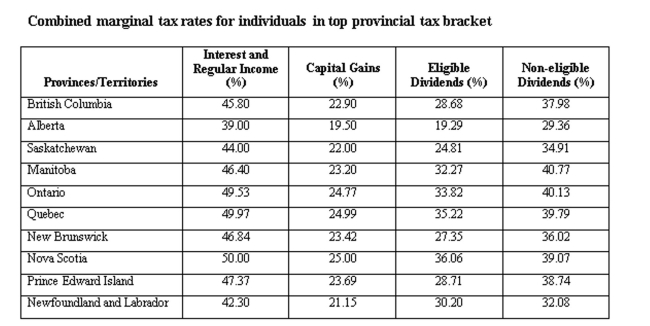

A Quebec resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 31.39%

B) 32.39%

C) 33.39%

D) 34.39%

E) 35.39%

Correct Answer:

Verified

Q176: A new firm issued $500 in common

Q177: What is the amount of the non-cash

Q178: Celeste Video, Inc. reports 2015 taxable income

Q179: Suppose that a firm paid dividends of

Q180: A $40,000 asset was purchased and classified

Q182: A Saskatchewan resident earned $40,000 in interest

Q183: The marginal tax rate on an income

Q184: Given the tax rates as shown, what

Q185: If provincial tax rates are 16% on

Q186: If provincial tax rates are 16% on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents