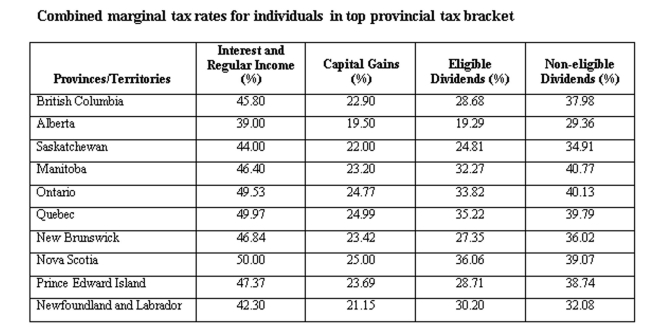

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $1,213.50 more than the Ontario resident.

B) British Columbia resident would pay $1,213.50 less than the Ontario resident.

C) British Columbia resident would pay $1,456.50 more than the Ontario resident.

D) British Columbia resident would pay $1,456.50 less than the Ontario resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Q255: Calculate the tax difference between a British

Q256: The ease and speed with which an

Q257: Calculate the tax difference between a British

Q258: The rationale for examining financial statements is

Q259: CCA Half-year rule is best described as:

A)

Q261: The earnings per share will:

A) Decrease if

Q262: Cash flow from assets represents the cash:

A)

Q263: Which of the following equation is correct?

A)

Q264: The cash flow from assets is equal

Q265: All else constant, the cash flow to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents