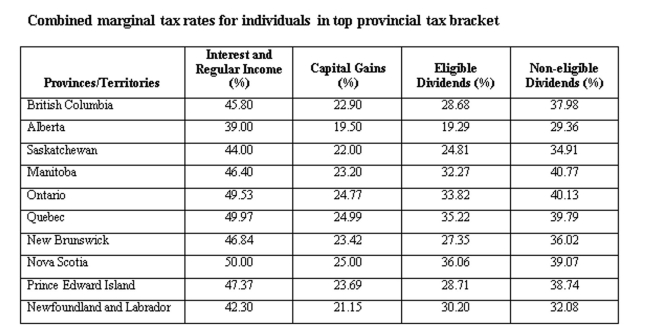

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $2,210.00 more than the Alberta resident.

B) British Columbia resident would pay $2,210.00 less than the Alberta resident.

C) British Columbia resident would pay $3,500.00 more than the Alberta resident.

D) British Columbia resident would pay $3,500.00 less than the Alberta resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Q252: Under GAAP, statement of financial position, assets

Q253: Cash flow to creditors is best described

Q254: Which of the following does NOT directly

Q255: Calculate the tax difference between a British

Q256: The ease and speed with which an

Q258: The rationale for examining financial statements is

Q259: CCA Half-year rule is best described as:

A)

Q260: Calculate the tax difference between a British

Q261: The earnings per share will:

A) Decrease if

Q262: Cash flow from assets represents the cash:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents