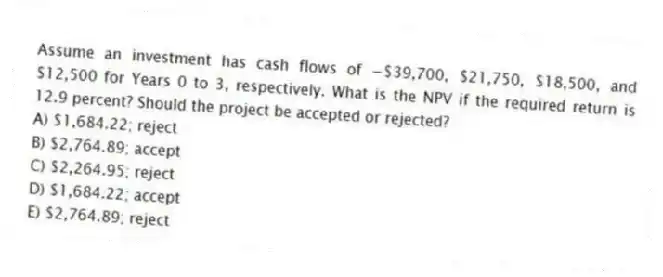

Assume an investment has cash flows of −$39,700, $21,750, $18,500, and $12,500 for Years 0 to 3, respectively. What is the NPV if the required return is 12.9 percent? Should the project be accepted or rejected?

A) $1,684.22; reject

B) $2,764.89; accept

C) $2,264.95; reject

D) $1,684.22; accept

E) $2,764.89; reject

Correct Answer:

Verified

Q73: A project has an initial cost of

Q74: Scott is considering a project that will

Q75: A project has an initial cost of

Q76: Project A has cash flows of -$74,900,

Q77: Alicia is considering adding toys to her

Q79: A project has cash flows of -$108,000,

Q80: You are considering two mutually exclusive projects.

Q81: Projects A and B are mutually exclusive.

Q82: Colin is analyzing a 3-year project that

Q83: You are considering two mutually exclusive projects.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents