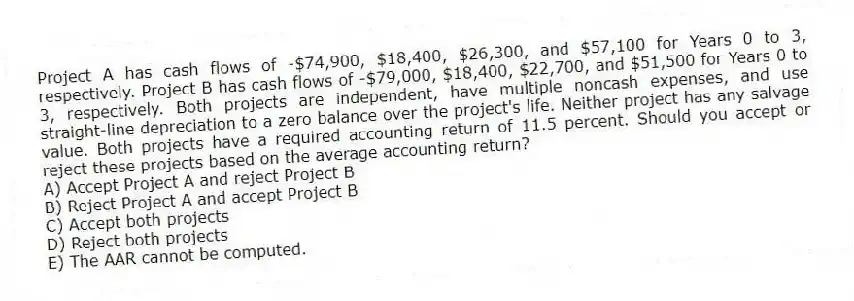

Project A has cash flows of -$74,900, $18,400, $26,300, and $57,100 for Years 0 to 3, respectively. Project B has cash flows of -$79,000, $18,400, $22,700, and $51,500 for Years 0 to 3, respectively. Both projects are independent, have multiple noncash expenses, and use straight-line depreciation to a zero balance over the project's life. Neither project has any salvage value. Both projects have a required accounting return of 11.5 percent. Should you accept or reject these projects based on the average accounting return?

A) Accept Project A and reject Project B

B) Reject Project A and accept Project B

C) Accept both projects

D) Reject both projects

E) The AAR cannot be computed.

Correct Answer:

Verified

Q71: JJ's is reviewing a project with a

Q72: A project has average net income of

Q73: A project has an initial cost of

Q74: Scott is considering a project that will

Q75: A project has an initial cost of

Q77: Alicia is considering adding toys to her

Q78: Assume an investment has cash flows of

Q79: A project has cash flows of -$108,000,

Q80: You are considering two mutually exclusive projects.

Q81: Projects A and B are mutually exclusive.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents