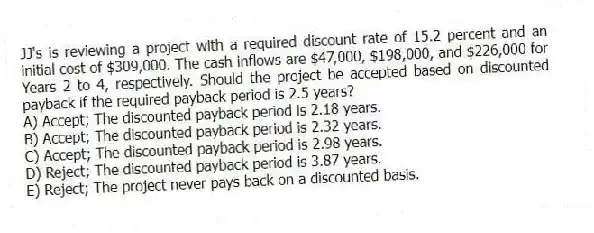

JJ's is reviewing a project with a required discount rate of 15.2 percent and an initial cost of $309,000. The cash inflows are $47,000, $198,000, and $226,000 for Years 2 to 4, respectively. Should the project be accepted based on discounted payback if the required payback period is 2.5 years?

A) Accept; The discounted payback period is 2.18 years.

B) Accept; The discounted payback period is 2.32 years.

C) Accept; The discounted payback period is 2.98 years.

D) Reject; The discounted payback period is 3.87 years.

E) Reject; The project never pays back on a discounted basis.

Correct Answer:

Verified

Q66: Project A has a required return on

Q67: An investment project costs $10,200 and has

Q68: A project produces annual net income amounts

Q69: A project has an initial cost of

Q70: An investment project provides cash flows of

Q72: A project has average net income of

Q73: A project has an initial cost of

Q74: Scott is considering a project that will

Q75: A project has an initial cost of

Q76: Project A has cash flows of -$74,900,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents