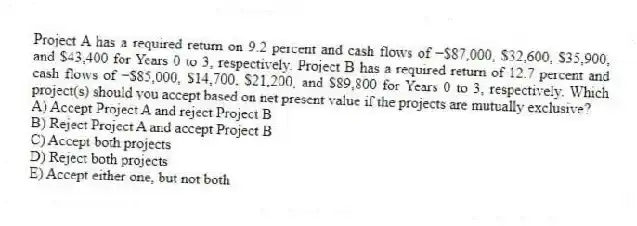

Project A has a required return on 9.2 percent and cash flows of −$87,000, $32,600, $35,900, and $43,400 for Years 0 to 3, respectively. Project B has a required return of 12.7 percent and cash flows of −$85,000, $14,700, $21,200, and $89,800 for Years 0 to 3, respectively. Which project(s) should you accept based on net present value if the projects are mutually exclusive?

A) Accept Project A and reject Project B

B) Reject Project A and accept Project B

C) Accept both projects

D) Reject both projects

E) Accept either one, but not both

Correct Answer:

Verified

Q61: It will cost $9,600 to acquire an

Q62: A project has an initial cost of

Q63: The Square Box is considering two independent

Q64: The Green Fiddle is considering a project

Q65: A project has an initial cost of

Q67: An investment project costs $10,200 and has

Q68: A project produces annual net income amounts

Q69: A project has an initial cost of

Q70: An investment project provides cash flows of

Q71: JJ's is reviewing a project with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents