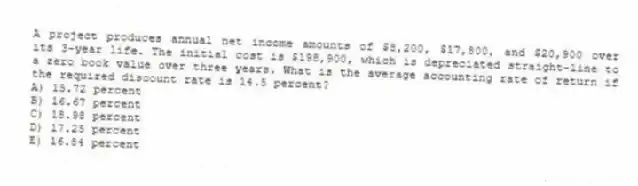

A project produces annual net income amounts of $8,200, $17,800, and $20,900 over its 3-year life. The initial cost is $198,900, which is depreciated straight-line to a zero book value over three years. What is the average accounting rate of return if the required discount rate is 14.5 percent?

A) 15.72 percent

B) 16.67 percent

C) 18.98 percent

D) 17.25 percent

E) 16.84 percent

Correct Answer:

Verified

Q63: The Square Box is considering two independent

Q64: The Green Fiddle is considering a project

Q65: A project has an initial cost of

Q66: Project A has a required return on

Q67: An investment project costs $10,200 and has

Q69: A project has an initial cost of

Q70: An investment project provides cash flows of

Q71: JJ's is reviewing a project with a

Q72: A project has average net income of

Q73: A project has an initial cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents