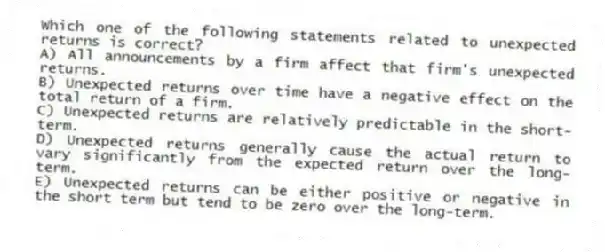

Which one of the following statements related to unexpected returns is correct?

A) All announcements by a firm affect that firm's unexpected returns.

B) Unexpected returns over time have a negative effect on the total return of a firm.

C) Unexpected returns are relatively predictable in the short-term.

D) Unexpected returns generally cause the actual return to vary significantly from the expected return over the long-term.

E) Unexpected returns can be either positive or negative in the short term but tend to be zero over the long-term.

Correct Answer:

Verified

Q15: If a stock portfolio is well diversified,

Q16: The expected rate of return on a

Q17: Unsystematic risk:

A) can be effectively eliminated by

Q18: The expected return on a portfolio considers

Q19: The expected return on a portfolio:

I. can

Q21: How many diverse securities are required to

Q22: Which one of the following measures the

Q23: Which one of the following statements is

Q24: The systematic risk of the market is

Q25: Which one of the following is most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents