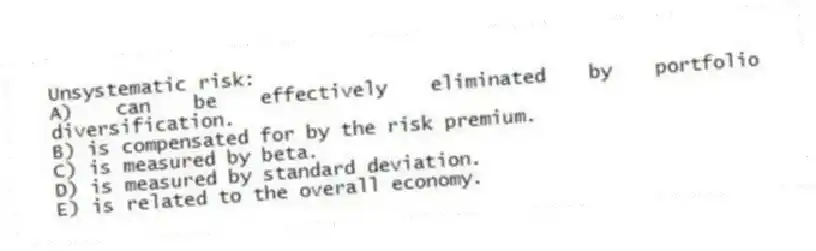

Unsystematic risk:

A) can be effectively eliminated by portfolio diversification.

B) is compensated for by the risk premium.

C) is measured by beta.

D) is measured by standard deviation.

E) is related to the overall economy.

Correct Answer:

Verified

Q12: Which one of the following statements is

Q13: Which one of the following is an

Q14: Suzie owns five different bonds and twelve

Q15: If a stock portfolio is well diversified,

Q16: The expected rate of return on a

Q18: The expected return on a portfolio considers

Q19: The expected return on a portfolio:

I. can

Q20: Which one of the following statements related

Q21: How many diverse securities are required to

Q22: Which one of the following measures the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents