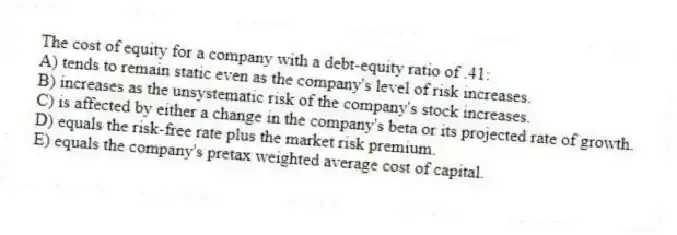

The cost of equity for a company with a debt-equity ratio of .41:

A) tends to remain static even as the company's level of risk increases.

B) increases as the unsystematic risk of the company's stock increases.

C) is affected by either a change in the company's beta or its projected rate of growth.

D) equals the risk-free rate plus the market risk premium.

E) equals the company's pretax weighted average cost of capital.

Correct Answer:

Verified

Q11: A group of individuals got together and

Q12: Textile Mills borrows money at a rate

Q13: A company's pretax cost of debt:

A) is

Q14: The primary advantage of using the dividend

Q15: The capital structure weights used in computing

Q17: Which one of these will increase a

Q18: The cost of capital for a new

Q19: The dividend growth model:

A) is only as

Q20: The aftertax cost of debt:

A) varies inversely

Q21: When computing the adjusted cash flow from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents