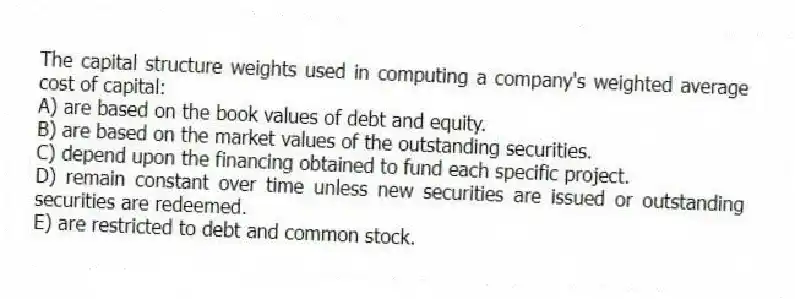

The capital structure weights used in computing a company's weighted average cost of capital:

A) are based on the book values of debt and equity.

B) are based on the market values of the outstanding securities.

C) depend upon the financing obtained to fund each specific project.

D) remain constant over time unless new securities are issued or outstanding securities are redeemed.

E) are restricted to debt and common stock.

Correct Answer:

Verified

Q10: Black River Tours has a capital structure

Q11: A group of individuals got together and

Q12: Textile Mills borrows money at a rate

Q13: A company's pretax cost of debt:

A) is

Q14: The primary advantage of using the dividend

Q16: The cost of equity for a company

Q17: Which one of these will increase a

Q18: The cost of capital for a new

Q19: The dividend growth model:

A) is only as

Q20: The aftertax cost of debt:

A) varies inversely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents