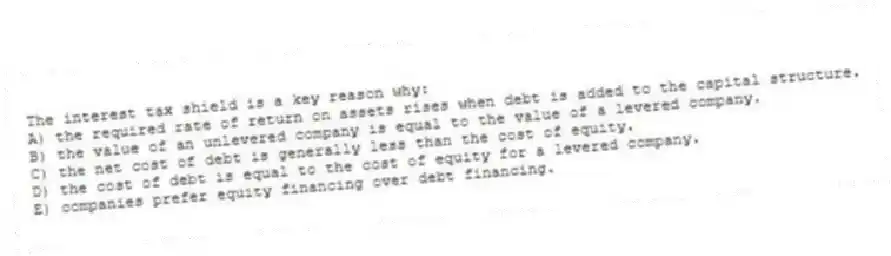

The interest tax shield is a key reason why:

A) the required rate of return on assets rises when debt is added to the capital structure.

B) the value of an unlevered company is equal to the value of a levered company.

C) the net cost of debt is generally less than the cost of equity.

D) the cost of debt is equal to the cost of equity for a levered company.

E) companies prefer equity financing over debt financing.

Correct Answer:

Verified

Q22: M&M Proposition II with taxes:

A) has the

Q23: M&M Proposition I with taxes is based

Q24: The symbol "RU" refers to the cost

Q25: The proposition that a company borrows up

Q26: Which one of the following is a

Q28: The capital structure that maximizes the value

Q29: The optimal capital structure of a company:

A)

Q30: Which one of the following provides the

Q31: The present value of the interest tax

Q32: Westover Mills reduced its taxes last year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents