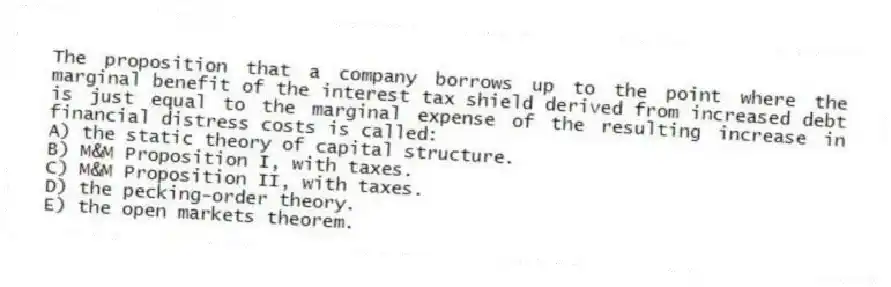

The proposition that a company borrows up to the point where the marginal benefit of the interest tax shield derived from increased debt is just equal to the marginal expense of the resulting increase in financial distress costs is called:

A) the static theory of capital structure.

B) M&M Proposition I, with taxes.

C) M&M Proposition II, with taxes.

D) the pecking-order theory.

E) the open markets theorem.

Correct Answer:

Verified

Q20: Which one of the following states that

Q21: The static theory of capital structure advocates

Q22: M&M Proposition II with taxes:

A) has the

Q23: M&M Proposition I with taxes is based

Q24: The symbol "RU" refers to the cost

Q26: Which one of the following is a

Q27: The interest tax shield is a key

Q28: The capital structure that maximizes the value

Q29: The optimal capital structure of a company:

A)

Q30: Which one of the following provides the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents