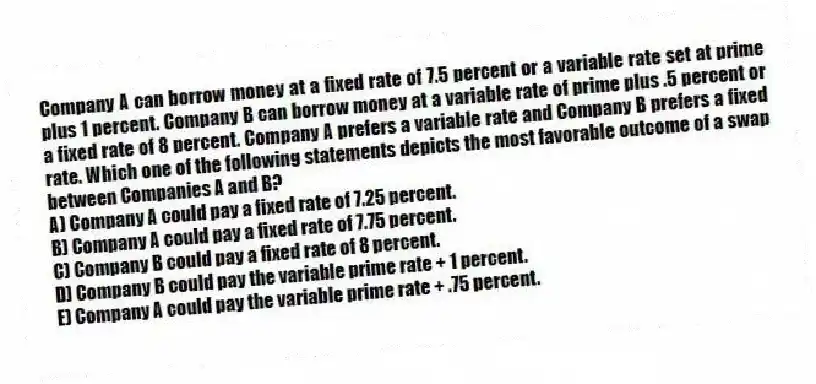

Company A can borrow money at a fixed rate of 7.5 percent or a variable rate set at prime plus 1 percent. Company B can borrow money at a variable rate of prime plus .5 percent or a fixed rate of 8 percent. Company A prefers a variable rate and Company B prefers a fixed rate. Which one of the following statements depicts the most favorable outcome of a swap between Companies A and B?

A) Company A could pay a fixed rate of 7.25 percent.

B) Company A could pay a fixed rate of 7.75 percent.

C) Company B could pay a fixed rate of 8 percent.

D) Company B could pay the variable prime rate + 1 percent.

E) Company A could pay the variable prime rate + .75 percent.

Correct Answer:

Verified

Q23: Which one of the following statements related

Q24: An agreement that grants its owner the

Q25: Dog's can borrow money at either a

Q26: Southern Groves raises tangerines. To hedge its

Q27: By definition, which one of the following

Q29: The futures contract on silver is based

Q30: Interest rate swaps:

A) are a group of

Q31: Murray's can borrow money at a fixed

Q32: A U.S. bank has an agreement with

Q33: All of the following are futures exchanges

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents