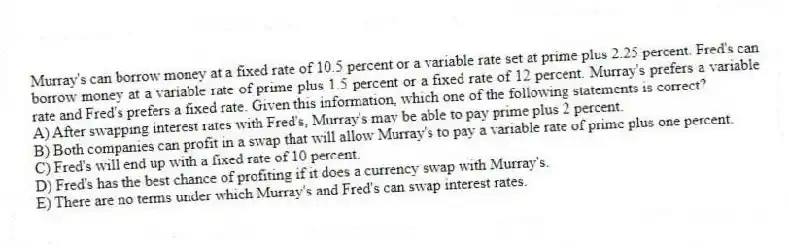

Murray's can borrow money at a fixed rate of 10.5 percent or a variable rate set at prime plus 2.25 percent. Fred's can borrow money at a variable rate of prime plus 1.5 percent or a fixed rate of 12 percent. Murray's prefers a variable rate and Fred's prefers a fixed rate. Given this information, which one of the following statements is correct?

A) After swapping interest rates with Fred's, Murray's may be able to pay prime plus 2 percent.

B) Both companies can profit in a swap that will allow Murray's to pay a variable rate of prime plus one percent.

C) Fred's will end up with a fixed rate of 10 percent.

D) Fred's has the best chance of profiting if it does a currency swap with Murray's.

E) There are no terms under which Murray's and Fred's can swap interest rates.

Correct Answer:

Verified

Q26: Southern Groves raises tangerines. To hedge its

Q27: By definition, which one of the following

Q28: Company A can borrow money at a

Q29: The futures contract on silver is based

Q30: Interest rate swaps:

A) are a group of

Q32: A U.S. bank has an agreement with

Q33: All of the following are futures exchanges

Q34: A call option contract:

A) obligates both the

Q35: Futures contracts:

A) are identical to forward contracts

Q36: Steve has an option with a payoff

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents