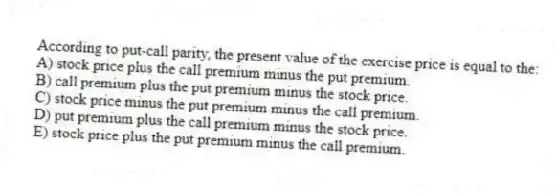

According to put-call parity, the present value of the exercise price is equal to the:

A) stock price plus the call premium minus the put premium.

B) call premium plus the put premium minus the stock price.

C) stock price minus the put premium minus the call premium.

D) put premium plus the call premium minus the stock price.

E) stock price plus the put premium minus the call premium.

Correct Answer:

Verified

Q5: Assume all stocks are non-dividend paying. Given

Q6: Which one of these is most equivalent

Q7: Travis owns a stock that is currently

Q8: In the Black-Scholes option pricing formula, N(d₁)

Q9: Which one of the following can be

Q11: All of the following affect the value

Q12: Assume the standard deviation of the returns

Q13: Assume the risk-free rate increases by one

Q14: Which one of the following defines the

Q15: When computing the value of a call

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents