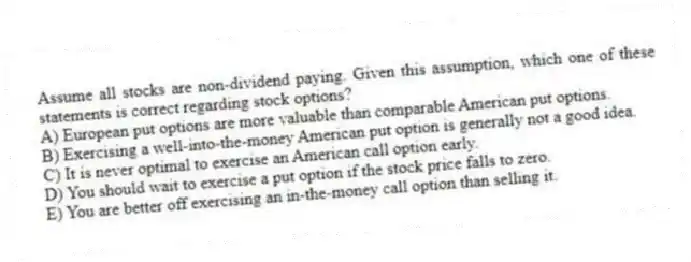

Assume all stocks are non-dividend paying. Given this assumption, which one of these statements is correct regarding stock options?

A) European put options are more valuable than comparable American put options.

B) Exercising a well-into-the-money American put option is generally not a good idea.

C) It is never optimal to exercise an American call option early.

D) You should wait to exercise a put option if the stock price falls to zero.

E) You are better off exercising an in-the-money call option than selling it.

Correct Answer:

Verified

Q1: Under European put-call parity, the present value

Q2: In the Black-Scholes option pricing model, the

Q3: Which one of the following statements is

Q4: In the put-call parity formula, the present

Q6: Which one of these is most equivalent

Q7: Travis owns a stock that is currently

Q8: In the Black-Scholes option pricing formula, N(d₁)

Q9: Which one of the following can be

Q10: According to put-call parity, the present value

Q11: All of the following affect the value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents