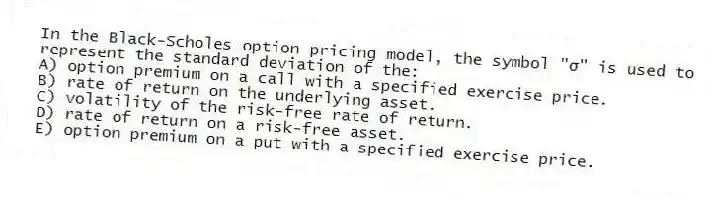

In the Black-Scholes option pricing model, the symbol "σ" is used to represent the standard deviation of the:

A) option premium on a call with a specified exercise price.

B) rate of return on the underlying asset.

C) volatility of the risk-free rate of return.

D) rate of return on a risk-free asset.

E) option premium on a put with a specified exercise price.

Correct Answer:

Verified

Q1: Under European put-call parity, the present value

Q3: Which one of the following statements is

Q4: In the put-call parity formula, the present

Q5: Assume all stocks are non-dividend paying. Given

Q6: Which one of these is most equivalent

Q7: Travis owns a stock that is currently

Q8: In the Black-Scholes option pricing formula, N(d₁)

Q9: Which one of the following can be

Q10: According to put-call parity, the present value

Q11: All of the following affect the value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents