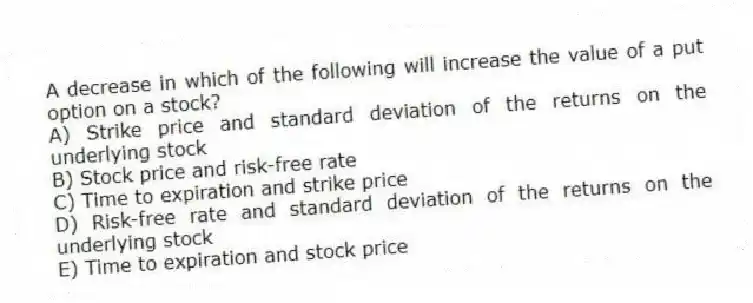

A decrease in which of the following will increase the value of a put option on a stock?

A) Strike price and standard deviation of the returns on the underlying stock

B) Stock price and risk-free rate

C) Time to expiration and strike price

D) Risk-free rate and standard deviation of the returns on the underlying stock

E) Time to expiration and stock price

Correct Answer:

Verified

Q33: Assume the risk-free rate increases. This change

Q34: If the price of the underlying stock

Q35: Theta measures an option's:

A) intrinsic value.

B) volatility.

C)

Q36: Which one of the following statements is

Q37: Selling a call option is generally more

Q39: Given a small change in the value

Q40: For the equity of a firm to

Q41: A put option that expires in eight

Q42: Today, you purchased 300 shares of Lazy

Q43: Webster United stock is priced at $35.79

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents