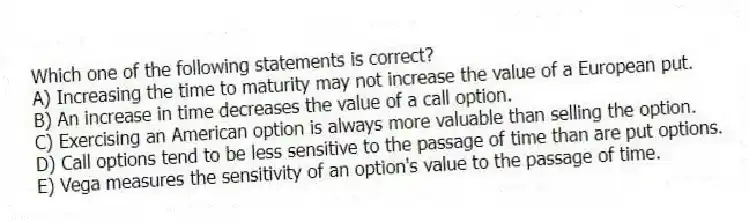

Which one of the following statements is correct?

A) Increasing the time to maturity may not increase the value of a European put.

B) An increase in time decreases the value of a call option.

C) Exercising an American option is always more valuable than selling the option.

D) Call options tend to be less sensitive to the passage of time than are put options.

E) Vega measures the sensitivity of an option's value to the passage of time.

Correct Answer:

Verified

Q31: Which one of the following statements related

Q32: The shareholders of a firm will benefit

Q33: Assume the risk-free rate increases. This change

Q34: If the price of the underlying stock

Q35: Theta measures an option's:

A) intrinsic value.

B) volatility.

C)

Q37: Selling a call option is generally more

Q38: A decrease in which of the following

Q39: Given a small change in the value

Q40: For the equity of a firm to

Q41: A put option that expires in eight

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents