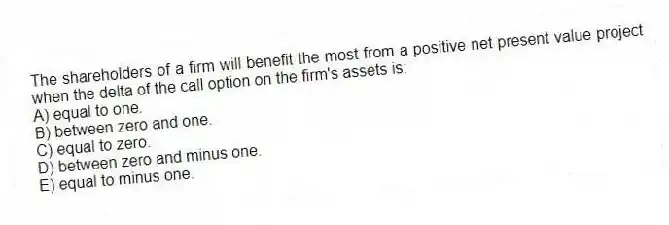

The shareholders of a firm will benefit the most from a positive net present value project when the delta of the call option on the firm's assets is:

A) equal to one.

B) between zero and one.

C) equal to zero.

D) between zero and minus one.

E) equal to minus one.

Correct Answer:

Verified

Q27: The estimate of the future volatility of

Q28: Purely financial mergers:

A) are beneficial to stockholders.

B)

Q29: The value of the risky debt of

Q30: Which one of the five factors included

Q31: Which one of the following statements related

Q33: Assume the risk-free rate increases. This change

Q34: If the price of the underlying stock

Q35: Theta measures an option's:

A) intrinsic value.

B) volatility.

C)

Q36: Which one of the following statements is

Q37: Selling a call option is generally more

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents