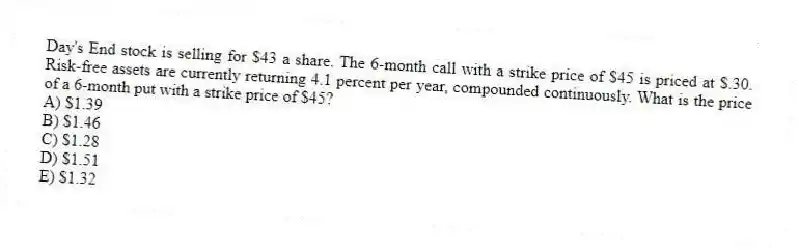

Day's End stock is selling for $43 a share. The 6-month call with a strike price of $45 is priced at $.30. Risk-free assets are currently returning 4.1 percent per year, compounded continuously. What is the price of a 6-month put with a strike price of $45?

A) $1.39

B) $1.46

C) $1.28

D) $1.51

E) $1.32

Correct Answer:

Verified

Q48: The stock of EHI has a current

Q49: The one-year call on TLM stock with

Q50: You need $15,400 in three years. How

Q51: A stock is selling for $62 per

Q52: A purely financial merger:

A) increases the risk

Q54: WT Foods stock is selling for $38

Q55: A call option with an exercise price

Q56: J&N stock has a current market price

Q57: Today, Ted purchased 500 shares of ABC

Q58: You invest $2,500 today at 5.5 percent,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents