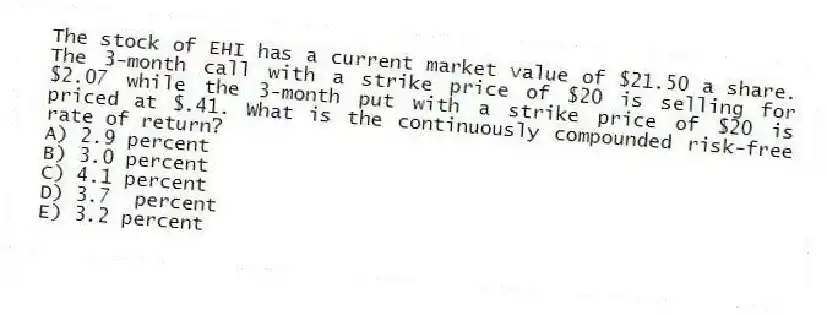

The stock of EHI has a current market value of $21.50 a share. The 3-month call with a strike price of $20 is selling for $2.07 while the 3-month put with a strike price of $20 is priced at $.41. What is the continuously compounded risk-free rate of return?

A) 2.9 percent

B) 3.0 percent

C) 4.1 percent

D) 3.7 percent

E) 3.2 percent

Correct Answer:

Verified

Q43: Webster United stock is priced at $35.79

Q44: What is the value of a 6-month

Q45: Which one of the following statements is

Q46: Grocery Express stock is selling for $22

Q47: Todd invested $12,000 in an account today

Q49: The one-year call on TLM stock with

Q50: You need $15,400 in three years. How

Q51: A stock is selling for $62 per

Q52: A purely financial merger:

A) increases the risk

Q53: Day's End stock is selling for $43

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents