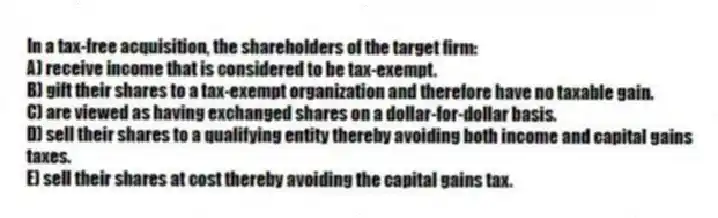

In a tax-free acquisition, the shareholders of the target firm:

A) receive income that is considered to be tax-exempt.

B) gift their shares to a tax-exempt organization and therefore have no taxable gain.

C) are viewed as having exchanged shares on a dollar-for-dollar basis.

D) sell their shares to a qualifying entity thereby avoiding both income and capital gains taxes.

E) sell their shares at cost thereby avoiding the capital gains tax.

Correct Answer:

Verified

Q26: All of the following represent potential tax

Q27: Which one of the following does not

Q28: A proposed acquisition is most apt to

Q29: If a merger creates synergy, then the:

A)

Q30: The purchase accounting method requires that:

A) the

Q32: All of the following represent potential gains

Q33: A potential merger that produces synergy:

A) should

Q34: Which one of the following is not

Q35: The value of a target firm to

Q36: Which one of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents