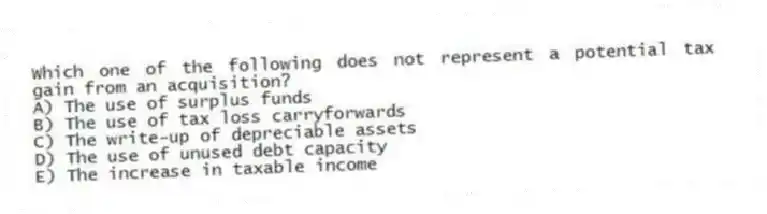

Which one of the following does not represent a potential tax gain from an acquisition?

A) The use of surplus funds

B) The use of tax loss carryforwards

C) The write-up of depreciable assets

D) The use of unused debt capacity

E) The increase in taxable income

Correct Answer:

Verified

Q22: Which one of the following best defines

Q23: For financial statement purposes, goodwill created by

Q24: If an acquisition does not create value

Q25: Which one of the following statements is

Q26: All of the following represent potential tax

Q28: A proposed acquisition is most apt to

Q29: If a merger creates synergy, then the:

A)

Q30: The purchase accounting method requires that:

A) the

Q31: In a tax-free acquisition, the shareholders of

Q32: All of the following represent potential gains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents