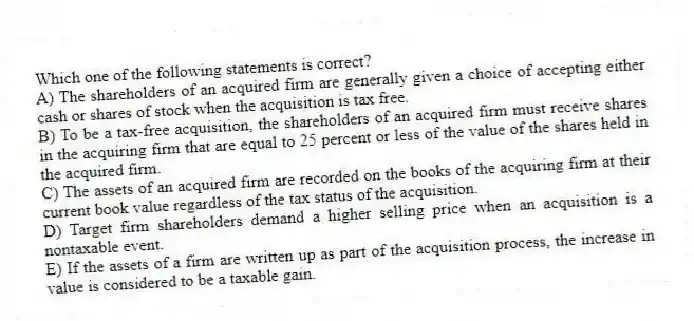

Which one of the following statements is correct?

A) The shareholders of an acquired firm are generally given a choice of accepting either cash or shares of stock when the acquisition is tax free.

B) To be a tax-free acquisition, the shareholders of an acquired firm must receive shares in the acquiring firm that are equal to 25 percent or less of the value of the shares held in the acquired firm.

C) The assets of an acquired firm are recorded on the books of the acquiring firm at their current book value regardless of the tax status of the acquisition.

D) Target firm shareholders demand a higher selling price when an acquisition is a nontaxable event.

E) If the assets of a firm are written up as part of the acquisition process, the increase in value is considered to be a taxable gain.

Correct Answer:

Verified

Q20: The Cat Box acquired The Dog House.

Q21: Assume the shareholders of a target firm

Q22: Which one of the following best defines

Q23: For financial statement purposes, goodwill created by

Q24: If an acquisition does not create value

Q26: All of the following represent potential tax

Q27: Which one of the following does not

Q28: A proposed acquisition is most apt to

Q29: If a merger creates synergy, then the:

A)

Q30: The purchase accounting method requires that:

A) the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents